Cyber Security: How to Protect your Farm from Cyberattacks

Cyber criminals do not discriminate! The farming community and rural industries are becoming more reliant on technology – whether to increase efficiency, reduce costs, optimise … Read more

Cyber criminals do not discriminate! The farming community and rural industries are becoming more reliant on technology – whether to increase efficiency, reduce costs, optimise … Read more

As insurance brokers for thousands of farms and farmers across the UK, we’re very aware of the rising costs the agriculture sector faces, including farm … Read more

Between April 2022 and March 2023, local authorities in England addressed 1.08 million fly-tipping incidents, which is a slight decrease of 1% compared to the … Read more

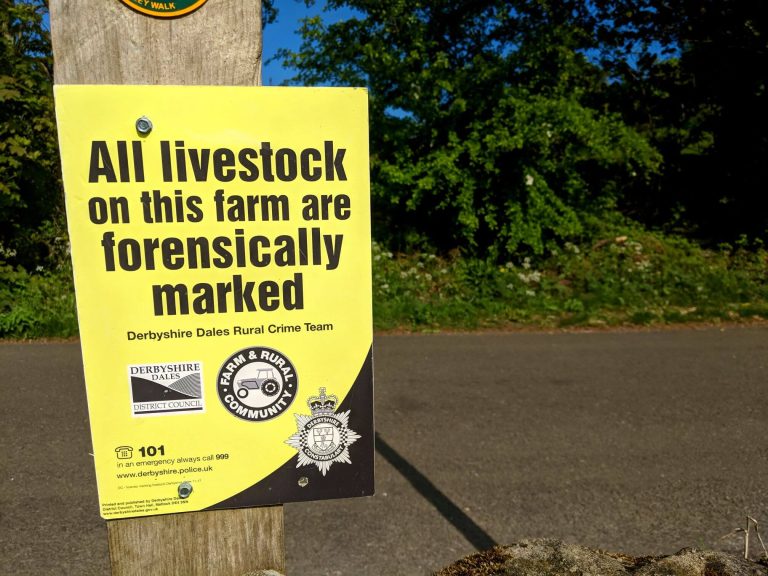

Livestock rustling is a common problem for farms and rural businesses of all sizes, and that’s not surprising when you consider there are 140,000 miles … Read more

Question: Each year when I review my insurances, I’m asked to confirm whether the rebuild values for all my buildings remain accurate. I don’t always … Read more

Branch Activity, General Interest, News

Why Howden is our new name – and no, it’s not to sell kitchens…

Branch Activity, , Cost of Living, General Interest

Is your town in the Top 10?

Here’s how to sort the cowboys from the cream of the crop…